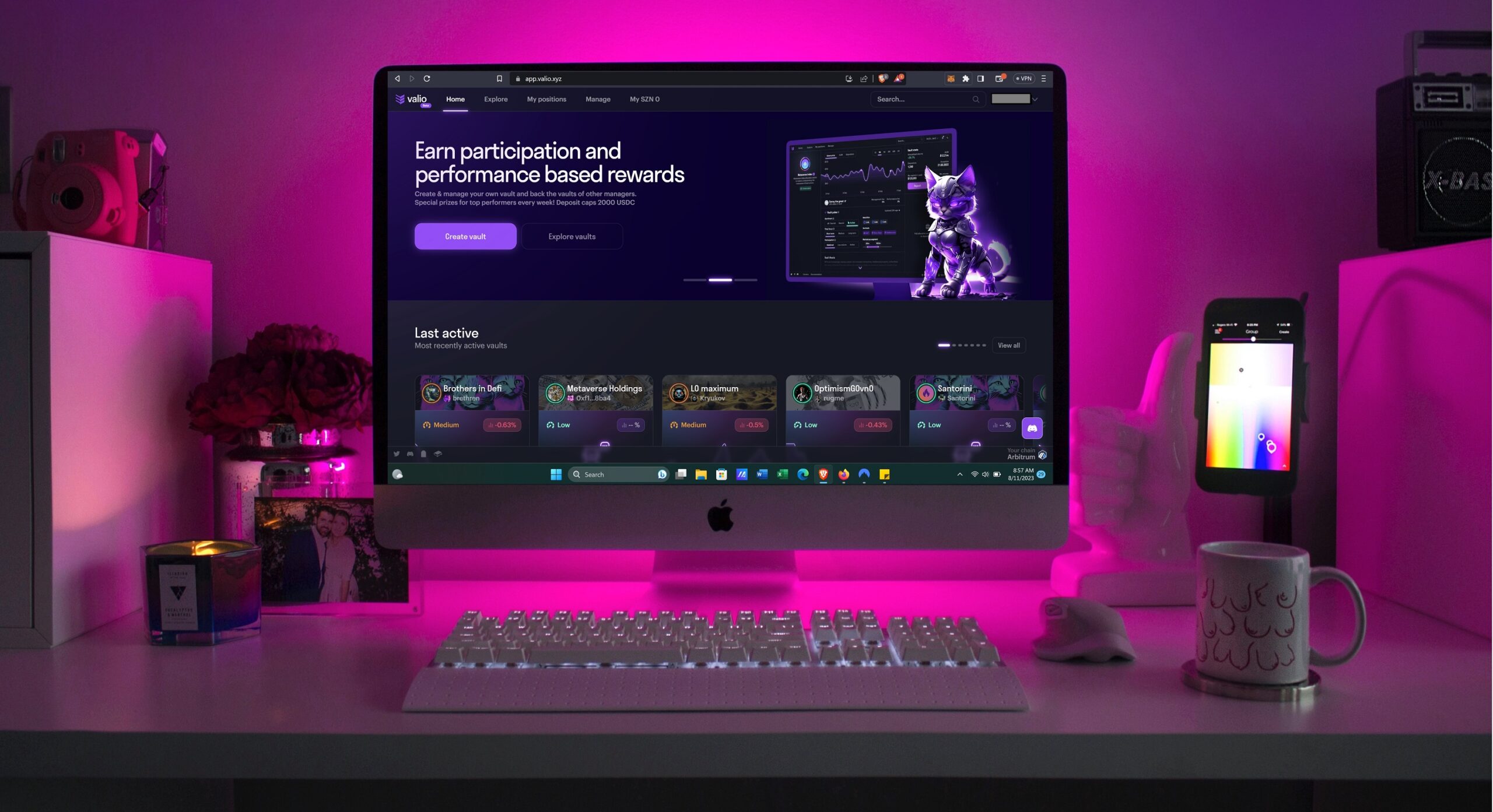

Valio is a new rendition of copy-trading, and asset management brought to decentralized finance on Arbitrum and Optimism layer two networks. I have personally been playing with Valio non-stop for days and am Intrigued but eager for enhancements and updates for this early-release project.

Introduction to Valio and what it can do

In simplest terms, Valio has taken a vault system and connected it to 0x protocol, GMX V1, and soon Yearn finance and Premia.

This allows any address to deposit funds into a vault controlled by a specific trader or entity that trades with the funds locked to the vault pro rata.

What does that mean in the real world?

- You can trustlessly deposit funds into a vault operated by the best-performing trader on Valio or spread funds between a portfolio of vaults.

- You can open vaults on Valio and earn performance and management fees on depositors who choose to vest with you.

Decentralized Valio is copy trading evolved.

Previously, copy trading consisted of shadowing and rapidly following accounts’ actions. The problem is, followed accounts could eventually figure this out and bait copy traders into traps. Most notable occurring in the NFT space, where liquidity games are the worst.

Valio improves upon large-scale copy trading by allowing ‘trade followers’ to vest with traders from the get-go for predetermined fees. The risk does remain for vault controllers to use funds maliciously to manipulate prices for their gain. However, doing so would tank the performance of their vault and, with it, their reputation.

Could a malicious vault operator keep opening new vaults under new accounts to grow them for eventual liquidity manipulation? This is entirely possible. We can only hope that over time with popularity, enough effort is put into account ratings, growth, and vault deposit caps to mitigate such gamification.

How to set up and use Valio as a vault manager or investor

Getting started with Valio is point-blank simple if you’re familiar with using your wallet. You will be depositing into vaults (smart contracts). Nothing fancy.

Investing in Valio Vaults

Investing in vaults on Valio is straightforward. You can assess each vault based on the vault’s performance as well as strategies listed by the vaults manager, including notes, time-frame preferences, trading pairs, trading style, and sentiment.

You are not required to put all your eggs into one basket either. You can diversify your funds across many vaults to limit risk on Valio. However, there are minimums and maximums.

Further vault investing customizations

When you invest in a vault, you can also set up automated conditions.

These include:

- Stop loss: exit vault upon % equity loss.

- Take profit: exit vault upon % equity gain.

In theory, you have a decent amount of control. Due to execution timing and liquidity conditions on the blockchain, such automated requirements will always be approximate.

CPIT Protection: Valio’s front line of defense against malicious managers

Valio’s core innovation is that trusting the manager is optional due to its unique CPIT security framework. CPIT (Cumulative Price Impact Tolerance) sets boundaries on the price impact managers can have on the capital they oversee. CPIT is a percentage of daily assets under management fixed at vault creation and applied differently across instruments like spot and lending markets.

Setting up and Operating a Valio Vault

While vault investing allows anyone to access any available trader to manage their funds in an isolated instance, vault management allows inspiring traders to earn access to funding.

Even if you are only starting your trading journey with $100, if you can grow to $300, people will notice that 200% gain on your vaults performance. This should attract investors to your vault, offering more funds to move and granting a sweet performance and management fee.

Vault set-up Instructions:

- Signature request from Valio using your wallet

- Add vault notes, build your vault profile

- Deposit at minimum $50 personally, or wait for someone else to deposit.

- Upon receiving funding (or giving yourself), you will manage a portfolio via 0x trading and GMX V1 trading.

However, not every component of Valio is operating frictionlessly.

Potential difficulties using Valio as a Vault Manager

Valio is very new and will undoubtedly be having plenty of updates in addition to adding support for Yearn Finance and Premia Options.

However, it is worth noting that trading with GMX on the Valio platform is not an exact science in its current form.

- Funding fees could be more visual.

- Fees generally need to be more accurate, showing exit values are often less after execution.

- Limited trading pairs.

- Worst of all: restricted collateral for long vs short. If you open a long, you will deposit wETH too long with. Upon closing your long, you will receive wETH back. However, if you would like to go short, you will need to first trade that wETH for USDC via 0x, which you can then use to short with. These conversions are gas-costly over time.

Conclusion on Valio Vault Investing and Vault Management

The concept of Valio is nothing short of fascinating. It makes massive sense if they release a governance token that earns protocol yield… Buckle up!

However, there is still a long way to go to make Valio a genuinely pleasurable and cost/fee-efficient model for the everyday user. I, for one, am much more satisfied trading on the leading Defi DEXes than I am trading on Valio at the moment.

Despite this, I cannot stop using Valio. Compared to all the clone leverage exchanges vampire attacking the defi market, it is new and exciting. CoinClaro is rooting for Valio.